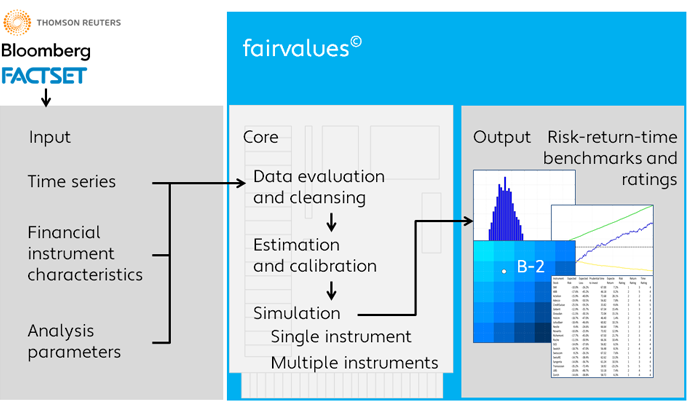

fairvalues© provides the basis for a consistent client advisory process which fulfills the regulatory requirements and allows the ongoing testing of investments regarding clients’ suitability and appropriateness. fairvalues© ensures a stringent communication of investment information and monitoring of investment portfolios. This allows to enhance the reliability of traditional and the development of digital advisory offerings.

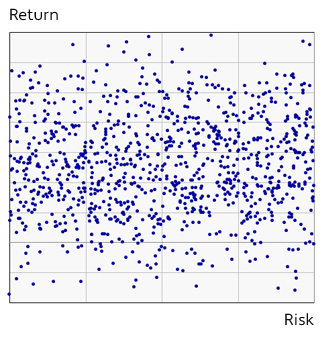

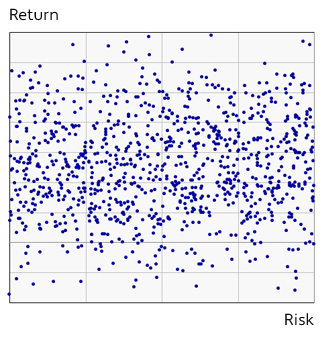

fairvalues© enables users to explore the risk-return universe of financial instruments and to systematically test their willingness and capabillity to take on risk for return. It takes three steps to construct and manage a unique portfolio for each individual client.

Starting Point

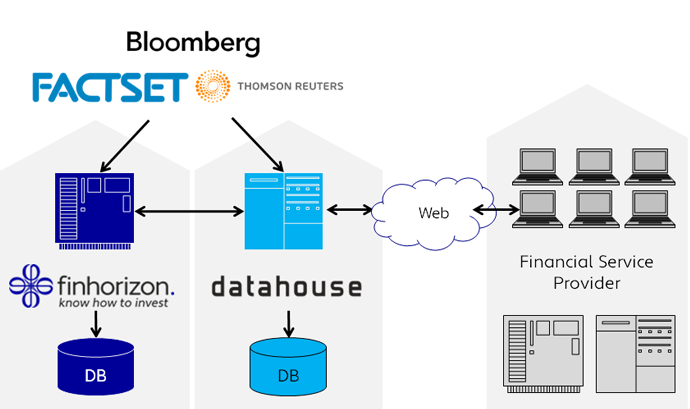

fairvalues© provides users with daily updated risk-return estimates.

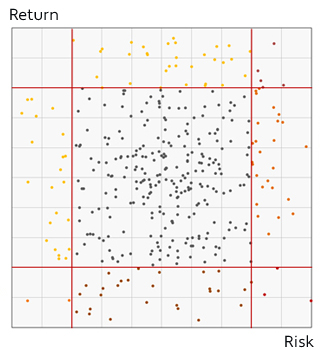

1 | Define constraints and exclusion criteriaUsers initialise fairvalues© agile investment approach by specifying: - Constraints: budget, time horizon, currency

- Exclusion criteria: countries, sectors, instruments

|  |

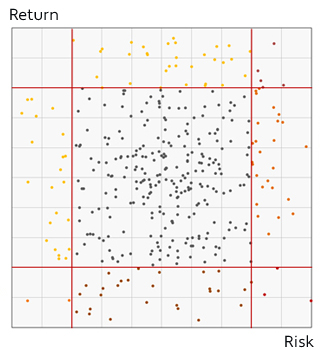

2 | TestingBased on estimated risk-return benchmark users can challenge their willingness and capability to take on risk for return and find out their assets meeting their goals. fairvalues© offers a visualised guided tour through the risk-return landscape to help find answers for the following key questions of investment: |  |

| - How much return the investor is prepared to sacrifice to reduce risk of loss?

- How much loss can an investor bear?

- What is the minimal return the investor expects to receive for the taken risk exposure?

This process will generate the following results: (1) users have systematically tested suitability and appropriateness of their investment decisions, being fully informed regarding the performance facts of financial markets, (2) list of financial instruments compliant with investors’ goals |

3 | Investing and controlling Given the securities in line with the goals of an investor fairvalues© allows to efficiently optimise portfolio diversification by maximising expected return. fairvalues© enables users to systematically monitor the performance of single instruments and portfolios based on user preferences and restrictions. Results: (1) individually optimal portfolios (2) continuous controlling reports and alerts |  |

Agile investing use cases

fairvalues© agile investing approach gives a financial services provider the ability to handle the following tasks

- Product selection

- Identification of financial instruments meeting their individual clients and client categories goals

- Preparing lists of financial instruments to be recommended to their clients

- Client advice

- Guide clients to find suitable and appropriate financial instruments

- Individualised investment offerings

- Continuous review of investments

- Identify in advance clients whose portfolios may move outside clients’ risk-return limits

- Portfolio adjustments propositions

- Promptly alerting clients

- Online advice for a self-guided investor by a visualised InvestmentGuide©

- Controlling

- Ability to have transparent visibility across portfolios of the entire client base

- Control instruments and performance

- Advice quality insurance by identification of best and worst performing portfolios

- Substantiation for reasoning